US iGaming Market: Why Do Established Online Gambling Affiliate Companies Suffer from Over-Competition?

Words: Michal Kurzanowski, CEO, OC24 LTD

The law of economics is at work in the US gambling market. Because of the opportunities that existed for growth, so many in the industry have targeted players from that country. I, Michal Kurzanowski, as the CEO igaming affiliate company OC24 Limited, can only describe the United States online gambling situation right now as being in a sorry state of oversaturation. This is the issue that I will be thoroughly discussing in this article.

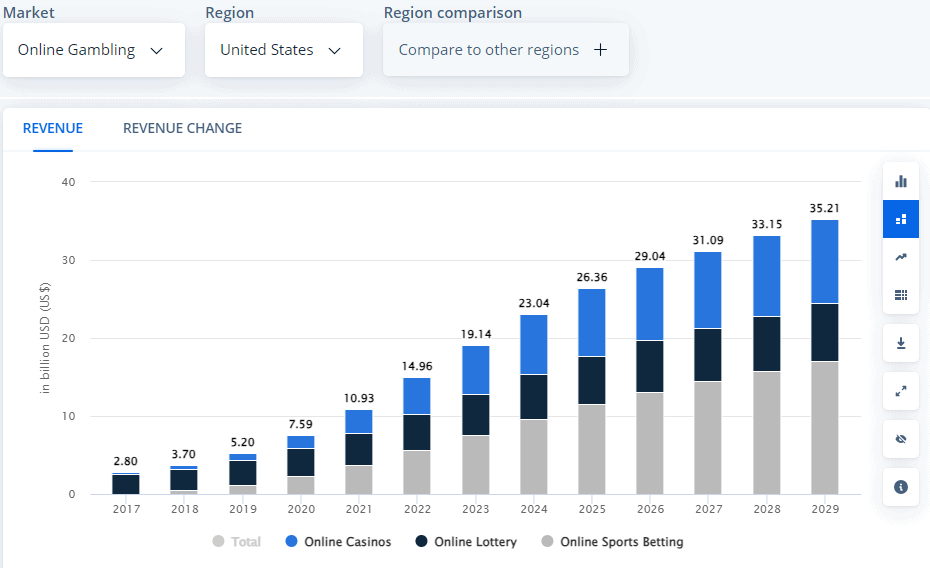

But if you have any level of familiarity with US gambling, you probably know that this sector has grown considerably in just one year. In fact, the total revenue from gambling has seen a whopping 10% growth from 2022. It was worth $66.52 billion last year!

“The rapid growth of the gambling USA market in just a year was something that everyone was watching closely. But despite this development, even well-known affiliates are seeing dents in their once-titanic revenues. Even the largest companies like Catena Media, Better Collective, GIG Media, Raketech, and Acroud were not spared. All of them reported a significant decrease in gross earnings”.

So how did a seemingly promising situation of growth for online gambling USA affiliates turn into a financial and strategic challenge? Let us delve into this topic together.

What Happened in the US Online Gambling Industry in Q4 2023?

As I’ve talked about in the introduction, the US gambling industry was, until recently, on a rapid growth trajectory. But where did this sudden expansion come from? Our assessment points to various factors:

- Growth of per capita income. The average person in America is now earning more than ever! This means greater disposable income that can be spent on various activities, like betting.

- Legalisation of gambling. Gambling has been legalised in many states, including: Kentucky, Maine, Massachusetts, Nebraska, and Ohio. This made potential online casino players more comfortable with the idea of gambling using a website.

- Digitalisation of millennials. The purchasing power of millennials has grown considerably as many of the people in this generation are now financially established. With the use of the internet becoming even more embedded into daily life, encountering online gambling US platforms is more likely than ever.

- Technological progress. Technology has advanced considerably, allowing affiliate brands to keep up with trends and expand the market size for online gambling.

Regulations on gambling vary by state. For example, some states allow land-based casinos but prohibit online gambling. Even though there can be strict state-based restrictions, the United States is still regarded as a TIER-1 market. This means it’s one of the largest (and, therefore, most profitable) generators of online gambling revenue in the world.

“Affiliate gambling entities with their roots deep in the US still suffer losses from the excessive competition. Smaller affiliates and European companies trying to get their slice of the US market are seen as the culprit. And the result? A highly saturated US affiliate landscape with the top affiliates fighting for the same audience without introducing differentiation.”

This insight is backed by statistics and reports for Q4 2023 and the overall earnings reports for 2023 compared to the same period last year. I have closely followed the events and trends using the latest reports, and below is a summary of what I have found:

- The share of Catena Media decreased in the fourth quarter of 2023 by 41%.

- Better Collective’s revenue is €1 million less than it was in Q4 2022.

- The GIG Media platform also reported an EBITDA decrease of 38.9% compared to 2022.

- Raketech raked in €1.17 million in profit for Q4 2023, significantly lower than €2.67 million in Q4 2022. EBITDA also decreased by 6.3% to €6 million in the same period according to the source.

- Acroud declared a 31% decrease in EBITDA from 2022 to 2023.

I invite you to think about the situation for smaller affiliates. If these giants weren’t able to mitigate losses; others may not have been able to survive at all.

What Is the Reason for the Poor Results of the Best-Known iGaming Affiliates?

CEOs have also identified other reasons for their declining revenues and EBIDTA. Higher CPA rates meant that even the biggest websites had to allocate more of their budget to expanding their client bases. They feel that some of the costs haven’t paid off well enough, such as implementing strategic investments in hiring top staff.

However, I think it still all boils down to the issue of oversaturation. The increased popularity of this form of entertainment attracted practically every casino and sports gambling affiliate out there to enter the American market. Both of these hamper any progress that they could have made if the US domain had not been saturated.

Many companies just placed too much faith in the prospect of getting the lion’s share of this market. They concentrated all their resources on this endeavor, which prevented them from absorbing the financial shock of failing to achieve their desired results. Catena Media, considered a powerhouse in the industry, made this mistake. It cost their then-CEO his position.

After the aftermath of the event that shook the foundations of even industry giants, some companies are looking to make 2024 the year of diversification. There have been talks of outsourcing SEO tasks, as Acroud did to innovate through external partners and improve margins.

Opportunities in More Diversified Markets Beyond Online Gambling in the US

Considering how competitive the situation is in the US, I don’t believe that this is the right time to focus all our efforts there. Looking at various gambling news updates, we already know that this is a losing strategy. After all, if Catena Media, with all its resources, cannot buy its way into creating a stronghold in the US, the chances of succeeding are truly slim to none.

This is not to say that the US gambling market is hopeless. But like any good investor, we must always be driven by facts instead of hype. Looking at how other companies diversified their allocation of resources across different markets, it’s even more evident how the Goliath that is Catena Media has been affected by their heavy investment in the US market.

Europe, Latin America, Asia, and other domains are all showing very promising growth. However, because the level of competition is not as intense as in the US, I strongly believe that casino affiliate marketing efforts there will have a higher rate of success.

Conclusion: Oversaturation May Be Driving Away Quality Players from theUS iGaming Industry

There are great prospects in the American online gambling market, and there are promising signs of dynamic growth. Unfortunately, there is just too much supply! Because of the existing oversaturation and high competition, our OC24 LTD team did not choose the US market as the main focus of its work.

There are better potential returns on investment in other domains, so we believe that shifting our focus to those markets is the most strategic move. Today, our company is actively implementing more than 15 promising projects in Europe, Asia, and Canada.

We’re not slowing down any time soon! Our experts at OC24 LTD are on the hunt for interesting new markets to help develop and thrive.

Would you like to be featured as a Guest Contributor with Affiverse? This content has been produced for Affiverse by a contributor and expresses their own views, in their own words. If you would like to feature as a contributor on Affiverse platforms, please email [email protected] with your article suggestion.